Bruma Finance offer personal loans at affordable rates from R 1000 up to R 15 000 with repayment periods of 6 to 18 months. At Bruma Finance they have professional employees that are ready to assist you and who know the urgency of your application and it is for this reason the pride in same-day response turnaround time. Bruma Finance Online Application The application process is fairly simple and is done online. To apply you need to visit the Bruma Finance website and click on apply and fill in your personal details online. Some of the details required include your

loans

loans

Budget Personal Loan

Apply for a budget persoal loan of up to R150 000 with up to 60 months repayment period.Fixed repayments that won’t go up even if interest rates do With a Budget Personal Loan you’ll enjoy: A choice of R2 000 up to R150 000 A choice of repayment terms that suit you – from 12 months up to 5 years Fast processing Transparent costs Competitive interest rates Fixed repayments that won’t go up even if interest rates do No face-to-face interviews No unnecessary paperwork No collateral required What you need to apply: A good credit record A regular

loans

1life Personal Loans

Are you looking for a quick cash loan, or perhaps you want to consolidate all your debt into one loan?Get a loan of up to R150 000 today at competitive interest rates.Whatever you wish for, call 0861 22 22 17 or apply for a personal loan through 1Life and make dreams come true! Why a 1Life Personal Loan? You can qualify with a regular income of just R5 000 Apply online for quick approval You choose your repayment term – from 12 to 60 months Competitive interest rates Fixed monthly repayments Do you qualify? If you have a regular

loans

1st for Women Personal Loans

A 1st for Women Personal Loan of up to R150 000 may be exactly what you need if you are in financial difficulties. Consolidate your accounts, finish off your dream kitchen or buy that much-needed new car – your personal loan is yours to use however you choose. And with no collateral required, there is no risk involved. 1st for Women Tailor made loans 1st for Women tailors your personal loan to suit you. You choose your loan amount – from R2 000 up to R150 000,and you can pick your repayment term, from 12 months up to five

loans

Woolworths Revolving Personal Loan – Cash in 48 hours

Enjoy flexible repayment terms with up to 60 months to pay with Woolworths Revolving Personal Loan and you are assured to get your Cash within 48 hours. Features of a Woolworths Revolving Loan Up to 60 months to pay Ability to withdraw a minimum loan of R1000, increasing in multiples of R500. The ability to re-use money that has been paid towards the loan. The convenience of access to cash through our easy interactive voice message system The choice of repayment periods and interest rates are designed to make it easier for you to manage your personal finances. Woolworths Financial Services

loans

Auto and General Personal Loan

With Auto and General Personal Loan, you may choose any amount, from R2 000 up to R150 000, as well as the repayment term, from 12 months up to 5 years, depending on how you’ve structured your budget. Interest rate will be fixed for the entire loan term so that fluctuations are not a cause for concern. For your financial wellbeing, auto & general Personal Loans* are compliant with the National Credit Act and your loan will never be approved for more than what you can comfortably afford to repay, and your final loan amount will be subject to

loans

Old Mutual My Money Plan Debt Consolidation

My Money Plan is Old Mutual Finance’s flagship product that allows you with up to R150 000 to consolidate your debt, combining it into one plan so that you pay a lower overall instalment payable in up to 60 months. This allows you to reduce your finance charges and increase your available cash, as My Money Plan also provides you with regular cash payouts when you need them most. How Old Mutual My Money Plan Works Qualify for a consolidation loan of up to R150 000. Minimum term of 1 month. Maximum term of 60 months. Fixed interest rate

loans

RCS Card

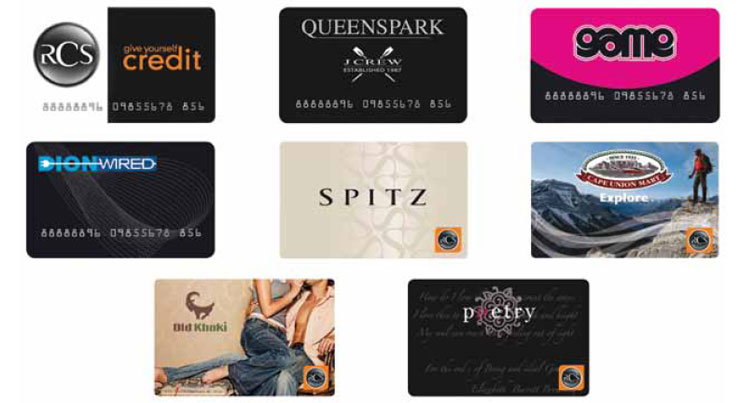

Get access to over 200 000 Stores on the largest shopping network in South Africa With an RCS Card. RCS offers different types of cards – a general-purpose card, a co-branded card and a Private Label card. GENERAL PURPOSE CARD The general-purpose card is RCS’ primary product. Cards are issued at point-of-sale with an average balance of R3600 and credit limits ranging from R750 to R40 000. The general purpose card is available to anyone and accepted at over 20 000 merchant outlets. RCS General Purpose Card PRIVATE LABEL CARD – RCS Private Label card offers a closed loop, white label

loans

Sanlam Personal Loan

Trust a Sanlam Personal Loan to suit your individual needs of up to R150 000 quick and easy. This loan comes at a fixed interest rate. Whether you need money for unexpected expenses, a medical emergency, or to fund a specific project, Sanlam can offer you a fixed rate personal loan according to your needs and circumstances. How Sanlam Personal Loans work You can apply for any amount, from R4 000 to R200 000 in increments of R1 000 You can tailor your repayment term to suit your budget (from 24 months to 6 years) Repayments are fixed for your

loans

Old Mutual Personal Loans

Old Mutual Personal Loans product called My Personal Loan is Old Mutual’s flagship product in micro finance. It allows you to borrow up to R100 000 qith a maximum term of up to 48 Months. How Old Mutual My Personal Loan Works Minimum loan term of 3 months. Maximum loan term of 48 months. Qualify for a personal loan of up to R100 000. Fixed interest rate at the time of the personal loan application. You need to be employed for at least 3 months at the same employer. The interest rate applied will be determined by your credit